unrealized capital gains tax janet

According to Yellen the funds collected would help finance things related to. An Act of War Against the Middle-Class Americans Criticize Janet Yellens Idea to Tax Unrealized Capital Gains The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US.

Taxing Unrealized Capital Gains A Bad Idea National Review

Treasury Secretary Janet Yellen is currently considering some shocking policies.

. Treasury Secretary Janet Yellens proposal backed by Democrats in the House of Representatives to include a tax on unrealized capital gains in President Joe Bidens spending plan has caused quite a stir. It is this unrealized capital gain that the administration proposes to tax not when sold but when valued. Heres Janet Yellen talking about taxing unrealized capital gains otherwise known as how to destroy America Oct 25th 2021 231 pm Oct 25th These people want you to own nothing like it and say nothing if the government juggernaut comes for.

As Cathie Wood states it is the worst proposal of all when it comes to stock. Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold. A tax on unrealized capital gains would be a direct tax because its a tax on personal property paid by someone who cannotquoting the Pollock decisionshift the burden upon some one sic else.

The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US. If I hold a volatile asset that goes up in value this new policy would force me to sell a bunch of that asset to pay for the taxes unless I had the cash to pay the taxes. Yellen explained the concept which aims to tax.

Be sure to like and subscribe and hit the bell button for channel alertsSend Fan Mail with USPS ToCOMMANDER VLOGSPO BOX 643EAST OLYMPIA WA 98540Send Fan. Janet Yellen Capital Gains Tax - YouTube An unrealized capital gains tax would change the stock market forever. Taxing unrealized capital gains also known as mark-to-market taxation What is an unrealized capital gain.

That is to say wed force people to pay taxes on gains they havent yet realized. Secretary of the treasury Janet Yellen discussed the subject on CNNs State of the Union. Senior Democrats confirmed that a proposal to tax billionaires unrealized capital gains will likely be included in President Bidens 2.

Bidens newly appointed US. Janet Yellen Discusses Unrealized Capital Gains Tax Proposal House Speaker Pelosi Approves. The first issue is that under the existing rules capital gains are only included in income for tax purposes when an item is sold and the gains are realized which implies that the seller receives a profit because of.

The Biden administration proposed that at death those gains be taxed. And we know that for some of the wealthiest individuals in the country they pay very low taxes overall because most of their income takes the form of unrealized capital gains. The phrase unrealized capital gains has been trending on social media and forums during the last 24 hours after the US.

Janet Yellen proposed in a speech that we taxed unrealized capital gains. Janet Yellen Discusses Unrealized Capital Gains Tax Proposal House Speaker Pelosi Approves. It goes against the concept of taxing income because thats a tax on generated cash flow whereas there is no generated cashflow in.

Treasury Secretary Janet Yellen Supports Taxing Unrealized Capital Gains Investments By W. The phrase unrealized capital gains has been trending on social media and forums during the last 24 hours after the US. Ron Wydens plan to tax unrealized capital gains of billionaires is something else.

A 2 drawdawn on your unrealized capital gains requires people to have set aside cash for that very tax purpose. BeInCrypto The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. President Biden Unveils Unrealized Capital Gains Tax for Billionaires Posted on 10252021 As US.

The plan will be included in the Democrats US 2 trillion reconciliation bill. Mencarow Published by Sovereign Wealth Fund Institute September 29 2021 Capital gains tax is a tax on the profit that investors realize on the sale of their assets. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains.

The Issues With Taxing Unrealized Capital Gains. Lawmakers are considering taxing unrealized capital gains. The Biden Administration is pretending that Oregon Sen.

An UNREALIZED GAIN is one in which the underlying asset is not sold but simply valued comparing the price from last year to the price this year even though you have not sold the asset and actually generated income. President Joe Biden receives an economic briefing with Treasury Secretary Janet Yellen in the Oval Office at the White House in Washington DC. How is this supposed to work.

Secretary of the treasury Janet Yellen discussed the subject on CNNs State of the Union Yellen explained the concept which aims to tax. Treasury Secretary nominee Janet Yellen reportedly said she would consider taxing unrealized capital gains but billionaire investor Howard Marks said its not a practical plan and could hurt. Bidens Capital-Gains Tax Grab Would Wreak Havoc.

Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. Taxed individuals hold onto these assets during their lifetime that income is never taxed.

Janet Yellen Not Planning A Wealth Tax But Could Do Capital Gains Tax

Unrealized Capital Gains Tax Stock Bitcoin Bitcoin Magazine Bitcoin News Articles Charts And Guides

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Here It Is Wyden S Unrealized Capital Gains Tax On Wealthy Americans Swfi

Capital Gains Definition 2021 Tax Rates And Examples

Lorde Edge And Unrealized Gains Tax No Safe Bets

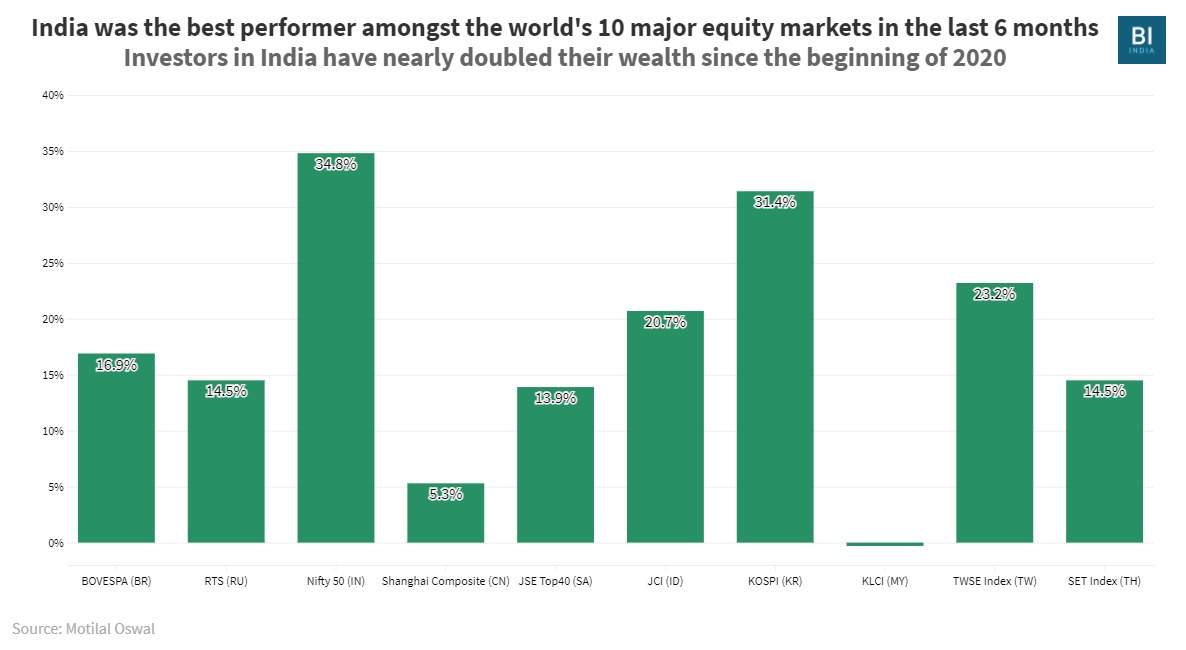

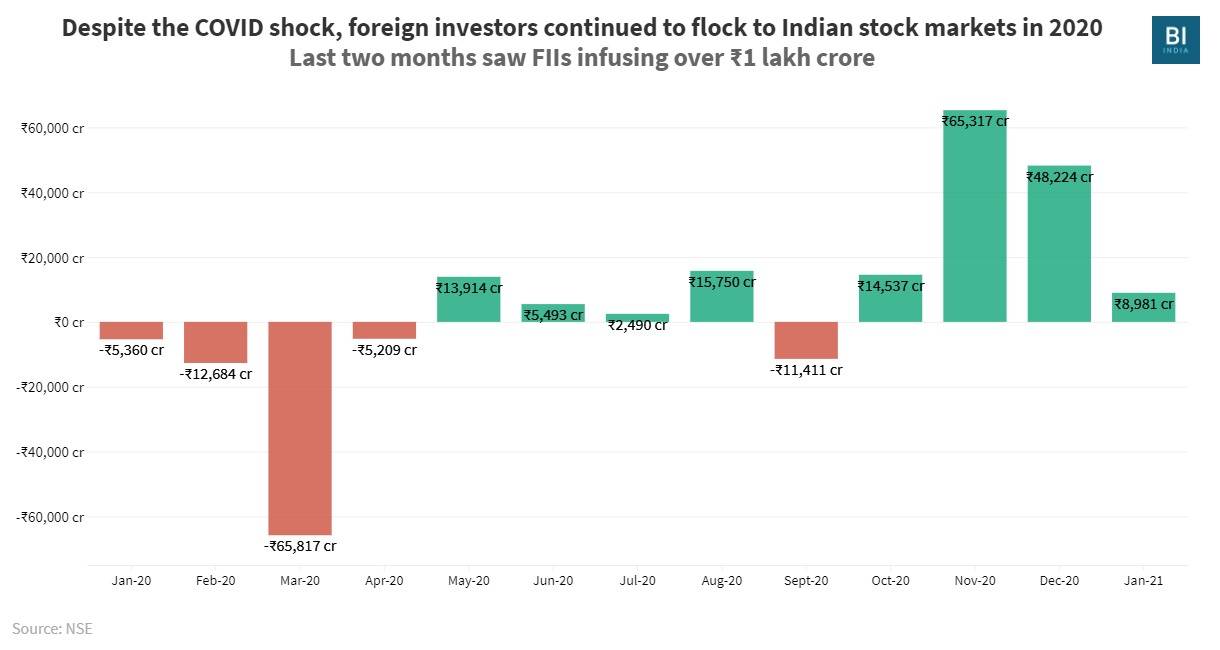

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

An Act Of War Against The Middle Class Americans Criticize Janet Yellen S Idea To Tax Unrealized Capital Gains Buyucoin Blog

Treasury Secretary Janet Yellen Says Taxing Unrealized Capital Gains Is A Possibility Youtube

Instagram Economics Idiots Rich People

Us Government Unrealized Gains Tax Plans Might Hit Crypto 039 Billionaires 039 Too In 2021 Bitcoin Currency Wealth Tax Capital Gains Tax

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Busines Capital Gains Tax Capital Gain What Is Capital

Nancy Pelosi Says A Wealth Tax On Billionaires Unrealized Gains Is On The Way Mish Talk Global Economic Trend Analysis

Wealthy Would Dodge 90 Of Biden S Capital Gains Tax Increase Study Says Cbs News

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Elon Musk Weighs In On Unrealized Capital Gains Tax Idea Channelchek

Janet Yellen Proposes Insane Capital Gains Tax On Bitcoin Youtube

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India